Medicare Part B vs Medicare Part D prescription drugs: How do they differ?

Let’s start off by defining Part B and Part D of Medicare.

Medicare Part B is the portion of Medicare that covers medical services, such as physician visits, durable medical equipment, and select prescription drugs that Medicare Part D does not cover. The most common Part B drugs are injectable or infused drugs such as chemotherapy and vaccinations. It might also be surprising to learn oral end-stage renal disease prescriptions, blood clotting medications, drugs commonly used to treat nausea and vomiting, select nebulizer solutions, transplant and immunosuppressive drugs, and insulins used with insulin pumps are included. Pumps are generally covered under Part B’s durable medical equipment benefit.

Medicare Part D covers prescription drugs through private insurance companies contracted with the federal government. These plans offer a wide range of prescription benefits, the list is known as a formulary. Formularies must cover at least two drugs in each approved category and class. Medicare Part D Prescription Drug insurers assign each drug under a tiered system. Both Prescription Drug and Medicare Advantage insurers generally offer prescription drugs in tiers 1-6. The lower the tier, the lower the patient copay or out-of-pocket cost.

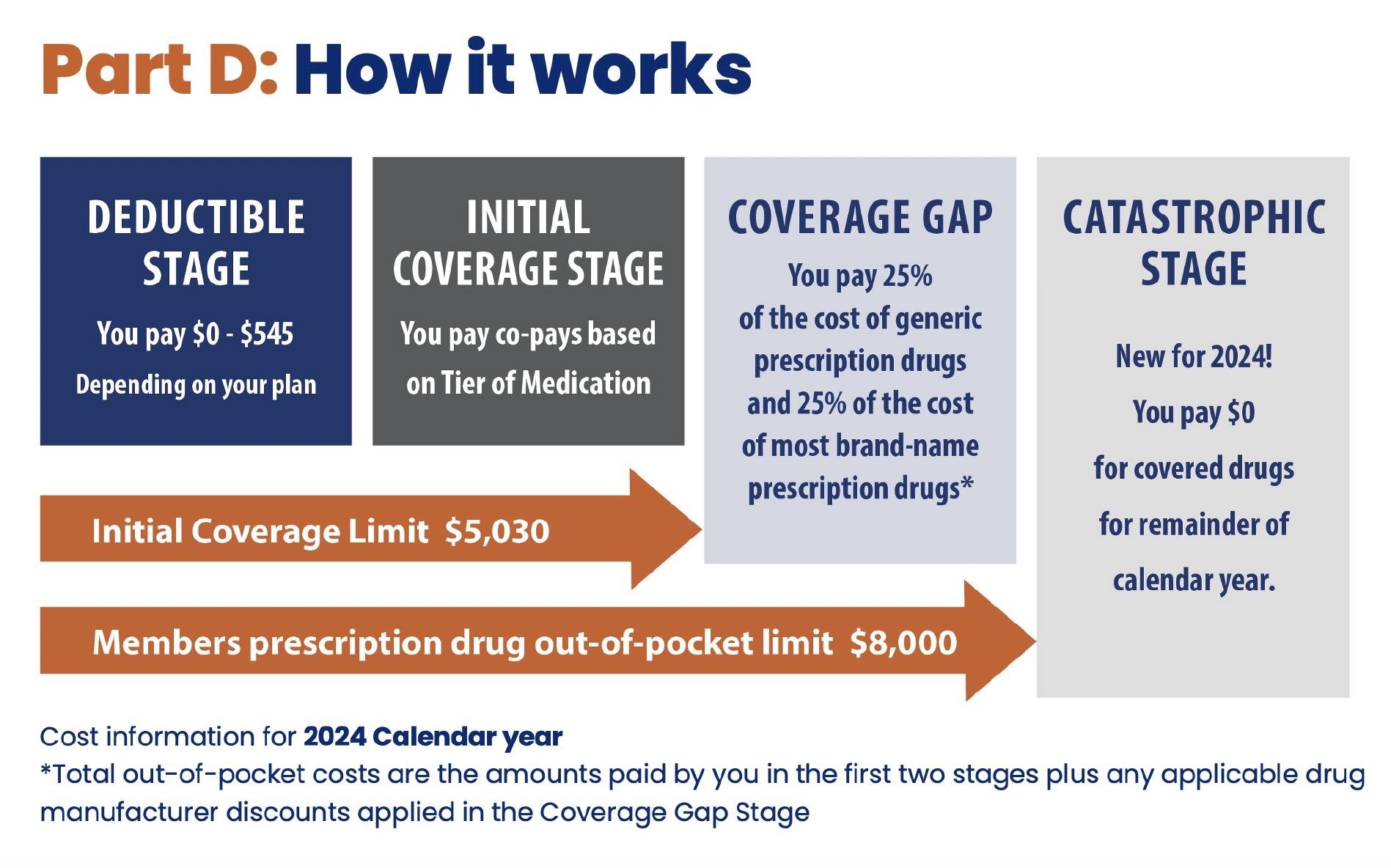

Part D plans generally have an annual deductible. In 2024, the maximum deductible is $545. The plan will cover it’s formulary price after the patient meets the annual deductible, known as the Initial Coverage Stage. During the Initial Coverage Stage the patient pays drug co-pays based on the tier of the drug. Upon reaching this Initial Coverage Limit of $5,030 (2024), the patient then moves into what is known as the Coverage Gap. During the Coverage Gap a patient pays 25% of the cost of generic and most name-brand drugs until their prescription drug out-of-pocket limit hits $8,000. Thereafter and for the remainder of the year, the patient is considered in a Catastrophic Stage and Part D covered drug copays are $0 until January 1, of the following year when a plan’s benefit design resets. What’s important to understand about Part D plans is that formularies can change more than once a year and can impact patient access to specific prescriptions.

It is vital to know the difference between covered Part B and Part D drugs. As an agent, provider, or pharmacist, Medicare beneficiaries depend on your expertise! While Medicare can be confusing, helping your clients or patients navigate the different parts of Medicare builds trust and loyalty.

Taryn Mott, Director of Provider Referral Operations and Training and long-time licensed insurance agent